A top Realtor in the Savannah area. Jeri Patrick has a team with an established history of success of selling homes in and around the Savannah Area. Jeri specializes in the home buying and selling process and is available to answer any of your real estate questions, provide information and handle any obstacles that may arise. Jeri Patrick began her Real Estate careers in 2002. Jeri’s strong ambition to be a success created a driving force in today’s real estate market.

Friday, December 20, 2019

Where Homeowners Get Decorative Inspiration

Where Homeowners Get Decorative Inspiration: Find out what consumers are most willing to spend extra money on when furnishing their homes.

How to Experience a Neighborhood Before Moving In

How to Experience a Neighborhood Before Moving In: Some house hunters are asking for a “test stay” at a home before signing the sale contract. Here are ways to accommodate their request.

Why Lenders Might Be Favoring Gen Z

Why Lenders Might Be Favoring Gen Z: The economy’s youngest generation has surprisingly high credit scores.

Wednesday, December 11, 2019

Tuesday, December 3, 2019

Monday, March 4, 2019

The Housing Market Will “Spring Forward” This Year!

The Housing Market Will “Spring Forward” This Year!

Just like our clocks this weekend, in the majority of the country, the housing market will soon “spring forward!” Similar to tension in a spring, the lack of inventory available for sale has been holding back the market.

Many potential sellers believe that waiting until Spring is in their best interest. Traditionally, they would have been right.

Buyer demand has seasonality to it. Usually, this falls off in the winter months, especially in areas of the country impacted by arctic conditions.

That hasn’t happened this year.

Demand for housing has remained strong as mortgage rates have remained near historic lows. Even with an increase in rates forecasted for 2019, buyers are still able to lock in an affordable monthly payment. Buyers are increasingly jumping off the fence and into the market to secure a lower rate.

The National Association of Realtors (NAR) recently reported that in 2018 the top 10 dates sellers listed their homes all fell in April, May, or June.

Those who act quickly and list now, before a flood of increased competition, will benefit from additional exposure to buyers.

Bottom Line

If you are planning on selling your home in 2019, meet with a local real estate professional to evaluate the opportunities in your market.

Friday, March 1, 2019

Home Prices Up 5.73% Across the Country!

Home Prices Up 5.73% Across the Country! [INFOGRAPHIC]

![Home Prices Up 5.73% Across the Country! [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2019/03/28120339/FHFA-ENG-MEM-1046x1600.jpg)

Some Highlights:

- The Federal Housing Finance Agency (FHFA) recently released their latest Quarterly Home Price Index report.

- In the report, home prices are compared both regionally and by state.

- Based on the latest numbers, if you plan on relocating to another state, waiting to move may end up costing you more!

Thursday, February 28, 2019

No Worries… Home Prices Coming in for a SOFT Landing

No Worries… Home Prices Coming in for a SOFT Landing

Home prices have appreciated considerably over the last five years. This has some concerned that we may be in for another dramatic correction. However, recent statistics suggest home values will not crash as they did a decade ago. Instead, this time they will come in for a soft landing.

The previous housing market was fueled by an artificial demand created by mortgage standards that were far too lenient. When this demand was shut off, a flood of inventory came to market. This included heavily discounted distressed properties (foreclosures and short sales).

Today’s market is totally different. Mortgage standards are tighter than they were prior to the last boom and bust. There is no fear that a rush of foreclosures will come to market. The Mortgage Bankers’ Association just announced that foreclosures are lower today than at any time since 1996.

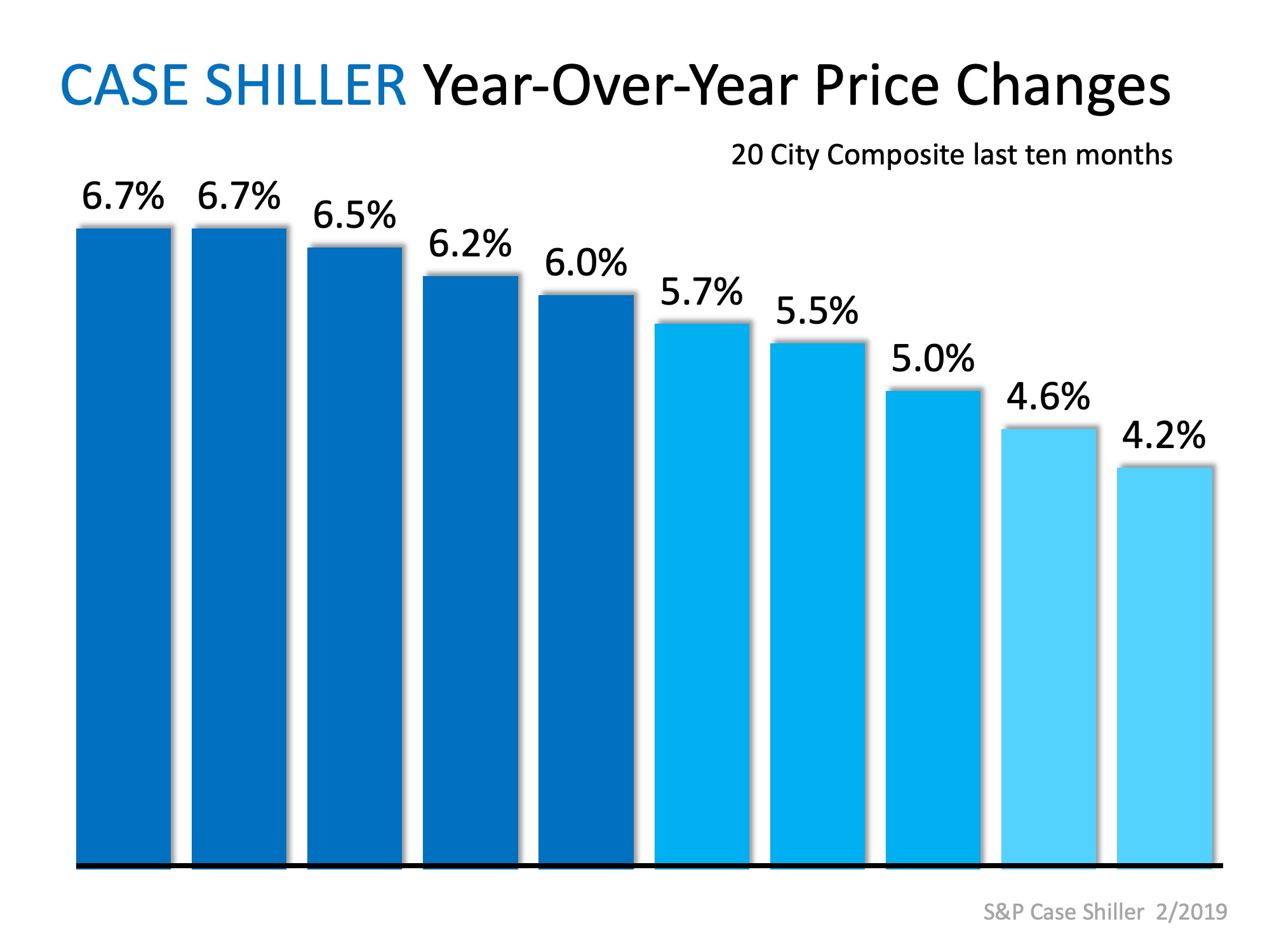

Case Shiller looks at the percentage of appreciation as compared to the same month the year prior. Here is a graph of their findings over the last ten months:

As we can see, home price appreciation is softening as more inventory comes to market. This shows that real estate prices are not crashing, but merely returning toward historic appreciation numbers of 3.6% annually.

Bottom Line

Home prices are leveling off. Long term, that is a good thing for the housing market.

Wednesday, February 27, 2019

Interest Rates Hit New 12 Month Low!

Interest Rates Hit New 12 Month Low!

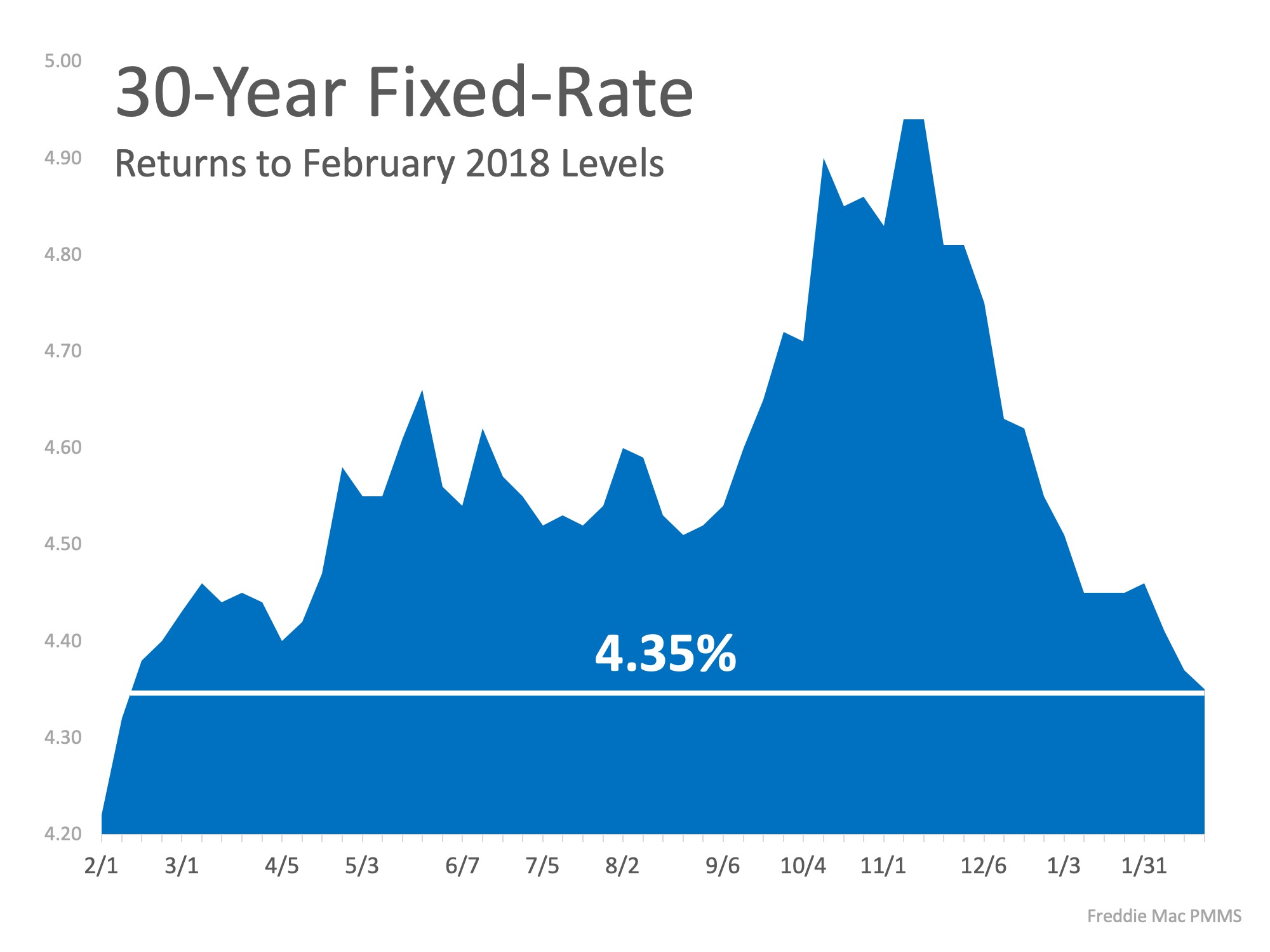

According to Freddie Mac’s Primary Mortgage Market Survey, interest rates for a 30-year fixed rate mortgage are currently at their lowest for 2019. Rates like these haven’t been seen since February 2018!

Last week’s survey results reported an interest rate of 4.35%. This is a welcome change from the near 5% rates seen in mid-November. At 4.32%, the second week of February 2018 was the last time rates were this low. This can be seen in the chart below.

Freddie Mac’s Chief Economist, Sam Khater, had this to say:

“Mortgage rates fell for the third consecutive week, continuing the general downward trend that began late last year.Wages are growing on par with home prices for the first time in years, and with more inventory available, spring home sales should help the market begin to recover from the malaise of the last few months.”

Bottom Line

If you plan on buying a home this spring, meet with a local real estate professional who can help prepare you for today’s market before rates increase!

Tuesday, February 26, 2019

What are the Benefits of Becoming a Homeowner?

What are the Benefits of Becoming a Homeowner?

Every family has a list of important dates. We celebrate birthdays, anniversaries, pet adoptions…and the list goes on. For 64.4 percent of households in the United States, this list includes the day they became a homeowner for the first time!

Why is this date important? Homeownership is not just a roof over your head! It represents shelter, stability, wealth, and pride! For decades, homeownership has been an important part of the American Dream!

However, many question if the next generations see the same benefits of homeownership as their predecessors.

In case we have forgotten, some of those benefits are:

Non-Financial Benefits

1) Educational Achievement: Homeownership has a positive impact on academic achievement, including reading and math performance in children 3-12 years old.

2) Civic Participation: “Owning a home means owning a part of the neighborhood.” Homeowners have a stronger connection to their neighborhood and are more committed to volunteer.

3) Health Benefits: Adjusting for a range of demographic, socioeconomic and housing-related characteristics, homeowners have a substantial health advantage over renters.

4) Public Assistance: The report shows 47% of homeowners use their home equity credit lines to help pay other debts, diminishing their need for public assistance.

5) Property Maintenance and Improvement: A well-maintained home not only generates benefits through consumption and safety, but a high-quality structure also raises mental health.

6) Pride of Ownership: This place is uniquely “yours.” You can customize it according to your likes and personality.

In addition to financial benefits, homeownership also brings significant social benefits. These not only pertain to the family, but extend to the communities, the state, and the country!

Financial Benefits

Buying a home is an investment in your future!

- Appreciation: On average, home prices are appreciating annually at a rate of 3.6%. This helps to create a safety net.

- Forced Savings: Your mortgage is like a forced savings plan! With each payment, you are reducing the principal of your loan.

- Home Equity: Homeownership builds equity every single month. You can later use that equity to start a business, send your children to college, etc.

- Net Worth: A homeowners’ net worth is 44x greater than renters! This gives you the financial freedom to invest.

- Stability: Rent prices increase 4% annually! A fixed mortgage payment allows you to save for future projects and guard against inflation.

- Tax Benefits: The government has created tax benefits to encourage customers to purchase. (Talk to your CPA to see which benefits apply to you).

Bottom Line

Homeownership is and will always be part of the American Dream! There are many financial and non-financial benefits to take advantage of when owning a home. If owning a home is part of your dream, contact a local real estate professional to help you with the process!

Monday, February 25, 2019

How Can I Increase My Family’s Net Worth?

How Can I Increase My Family’s Net Worth?

Every three years, the Federal Reserve conducts their Survey of Consumer Finances. Data is collected across all economic and social groups. The latest survey data covers 2013-2016.

The study revealed that the median net worth of a homeowner is $231,400 – a 15% increase since 2013. At the same time, the median net worth of renters decreased by 5% ($5,200 today compared to $5,500 in 2013).

These numbers reveal that the net worth of a homeowner is over 44 times greater than that of a renter.

Owning a home is a great way to build family wealth.

As we’ve said before, simply put, homeownership is a form of ‘forced savings.’ Every time you pay your mortgage, you are contributing to your net worth by increasing the equity in your home.

That is why Gallup reported that Americans picked real estate as the best long-term investment for the fifth year in a row. According to this year’s results, 34% of Americans chose real estate. Stocks followed at 26%, and then gold, savings accounts/CDs, or bonds.

Bottom Line

If you want to find out how you can use your monthly housing cost to increase your family’s wealth, let’s get together to guide you through the process.

Friday, February 22, 2019

3 Tips for Making Your Dream of Buying A Home Come True

3 Tips for Making Your Dream of Buying A Home Come True [INFOGRAPHIC]

![3 Tips for Making Your Dream of Buying A Home Come True [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2019/02/20084419/3-Tips-ENG-MEM-1046x1354.jpg)

Some Highlights:

- Setting up an automatic savings plan that saves a small amount of every check is one of the best ways to save without thinking too much about it.

- Living within a budget right now will help you save money for down payments while also paying down other debts that might be holding you back.

- What are you willing to cut back on to make your dreams of homeownership a reality?

Thursday, February 21, 2019

3 Reasons Why We Are Not Heading Toward Another Housing Crash

3 Reasons Why We Are Not Heading Toward Another Housing Crash

With home prices softening, some are concerned that we may be headed toward the next housing crash. However, it is important to remember that today’s market is quite different than the bubble market of twelve years ago.

Here are three key metrics that will explain why:

- Home Prices

- Mortgage Standards

- Foreclosure Rates

HOME PRICES

A decade ago, home prices depreciated dramatically, losing about 29% of their value over a four-year period (2008-2011). Today, prices are not depreciating. The level of appreciation is just decelerating.

Home values are no longer appreciating annually at a rate of 6-7%. However, they have still increased by more than 4% over the last year. Of the 100 experts reached for the latest Home Price Expectation Survey, 94 said home values would continue to appreciate through 2019. It will just occur at a lower rate.

MORTGAGE STANDARDS

Many are concerned that lending institutions are again easing standards to a level that helped create the last housing bubble. However, there is proof that today’s standards are nowhere near as lenient as they were leading up to the crash.

The Urban Institute’s Housing Finance Policy Center issues a quarterly index which,

“…measures the percentage of home purchase loans that are likely to default—that is, go unpaid for more than 90 days past their due date. A lower HCAI indicates that lenders are unwilling to tolerate defaults and are imposing tighter lending standards, making it harder to get a loan. A higher HCAI indicates that lenders are willing to tolerate defaults and are taking more risks, making it easier to get a loan.”

Last month, their January Housing Credit Availability Index revealed:

“Significant space remains to safely expand the credit box. If the current default risk was doubled across all channels, risk would still be well within the pre-crisis standard of 12.5 percent from 2001 to 2003 for the whole mortgage market.”

FORECLOSURE INVENTORY

Within the last decade, distressed properties (foreclosures and short sales) made up 35% of all home sales. The Mortgage Bankers’ Association revealed just last week that:

“The percentage of loans in the foreclosure process at the end of the fourth quarter was 0.95 percent…This was the lowest foreclosure inventory rate since the first quarter of 1996.”

Bottom Line

After using these three key housing metrics to compare today’s market to that of the last decade, we can see that the two markets are nothing alike.

Wednesday, February 20, 2019

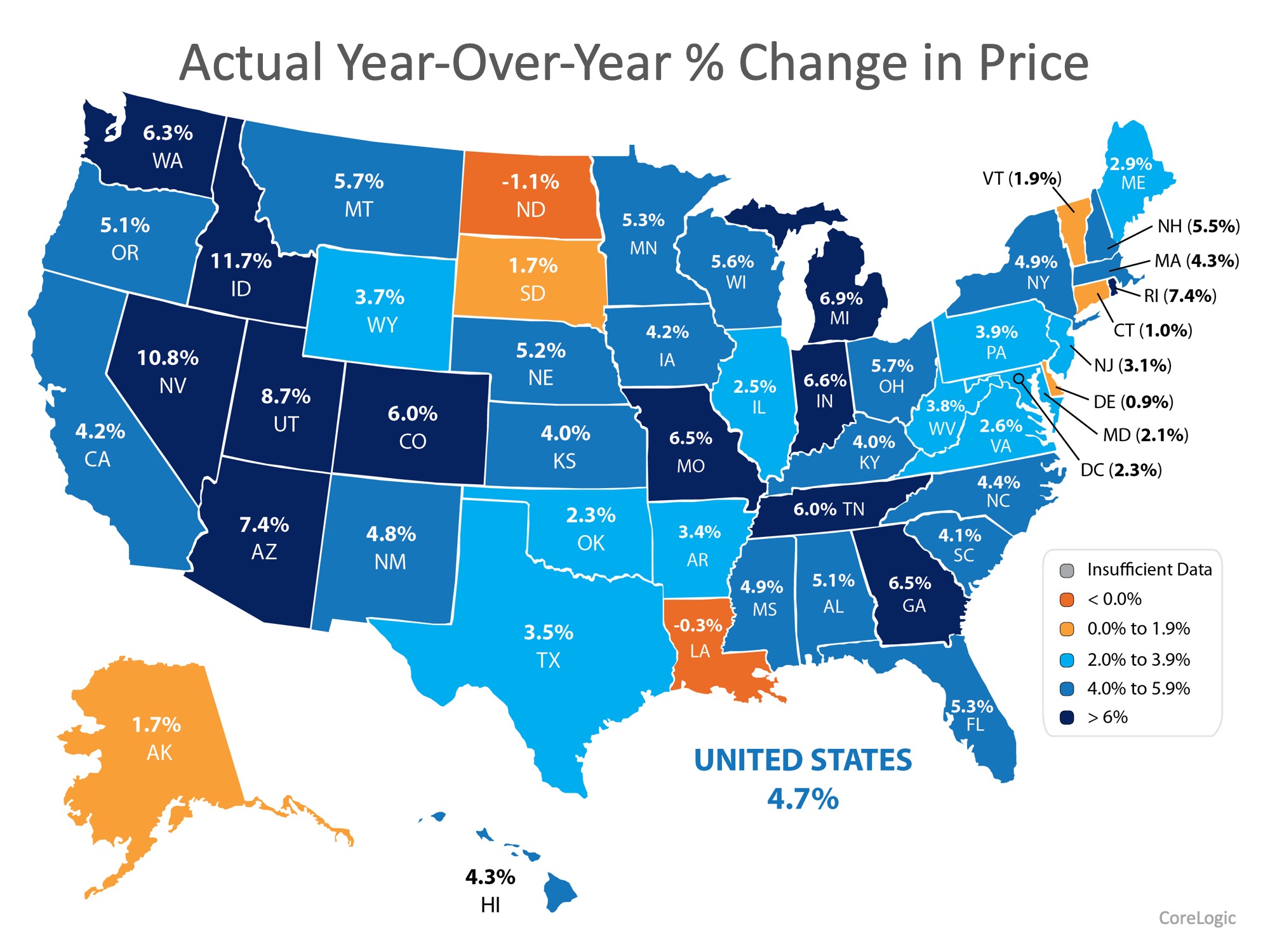

Why A Normal Market is Just What We Need

Why A Normal Market is Just What We Need

The housing market has been hot for a while now. Homes have been flying off the shelves as fast as they have been listed. Buyers have been competing in bidding wars just to find a home to buy, let alone find their dream home.

This ‘seller’s market’ has driven home prices to new heights. Home price appreciation averaged over 6% across the country.

However, home price growth has recently started to cool down. The latest report from CoreLogic shows that home prices have only risen by 4.7% over the last 12 months.

Many buyers and sellers planning to enter the housing market this year have started to wonder if we are headed towards another housing crash. Ralph McLaughlin, Deputy Chief Economist at CoreLogic, recently stated in an interview,

“There’s no reason to panic right now, even if we may be headed for a recession. We’re seeing a cooling of the housing market, but nothing that indicates a crash.The real elephant in the room here is housing supply.”

The simple answer is we are returning to a ‘normal’ market. The inventory of homes for sale more closely matches the demand in the market. The added supply means fewer buyers are outbidding each other. Therefore, prices are experiencing less upward pressure. McLaughlin went on to explain,

“If there are a lot of homes on the market and suddenly no one wants to buy them, you’ll get into a downward spiral of price competition. Right now, however, we’re in the opposite situation, there isn’t an over-abundance of homes on the market.”

As more renters looking for their piece of the American Dream enter the housing market, demand for housing will continue to grow. The Joint Center for Housing Studies at Harvard University estimates over 30 million new households will enter the market from now through 2040.

“There’s the natural life cycle of young people getting older and starting to do adult life things which include … buying a house and that’s a lot of potential inertia that could last indefinitely.”

Bottom Line

Home prices will start to appreciate by historical norms as we continue to head towards a more ‘normal’ market, rather than the over 6% seen over the course of the last couple of years. This is great news! Homeowners looking to sell their home will have buyers, as more buyers will be able to afford them!

Tuesday, February 19, 2019

2019 Will Be a Great Year for Buyers AND Sellers

2019 Will Be a Great Year for Buyers AND Sellers

Many homeowners believe that rising interest rates and home prices have scared away buyers and therefore have not listed their houses for sale. However, the truth is that buyers who were unable to find a home last year are out in force, and there are even more coming!

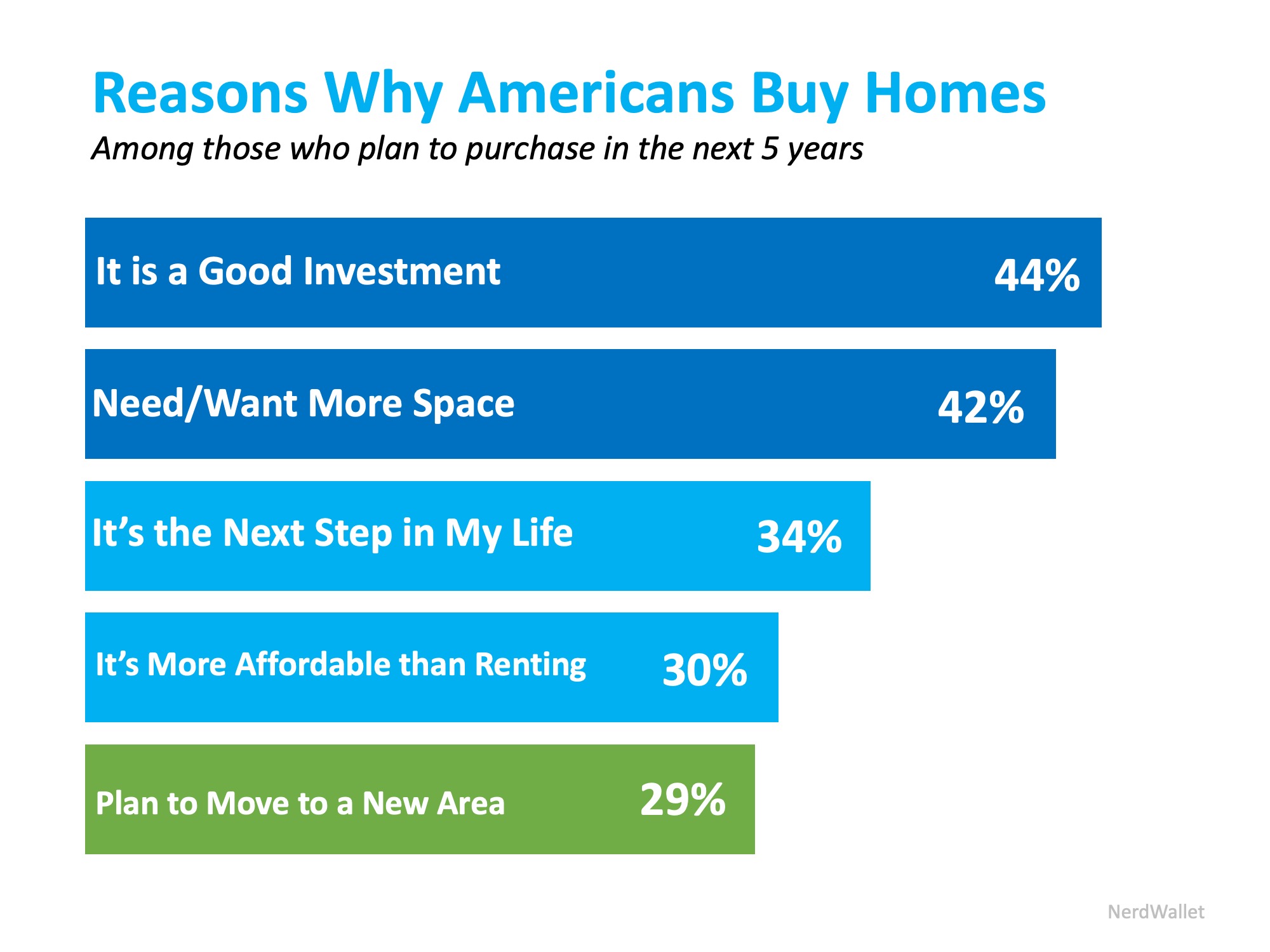

NerdWallet’s 2018 Home Buyer Report revealed that:

“Approximately one-third (32%) of Americans plan to purchase a home in the next five years. Millennials are most likely to have such a purchase in their five-year plan (49%), versus 35% of Generation X and 17% of baby boomers.”

As we can see, buyers are optimistic! According to the report, here are the top reasons Americans plan to buy:

The most common reason Americans prioritize buying is that they believe it’s a good investment!

If you’re a homeowner looking to sell, 2019 is the perfect year to put your house on the market. But why?

- Buyers want to buy

- No competition!

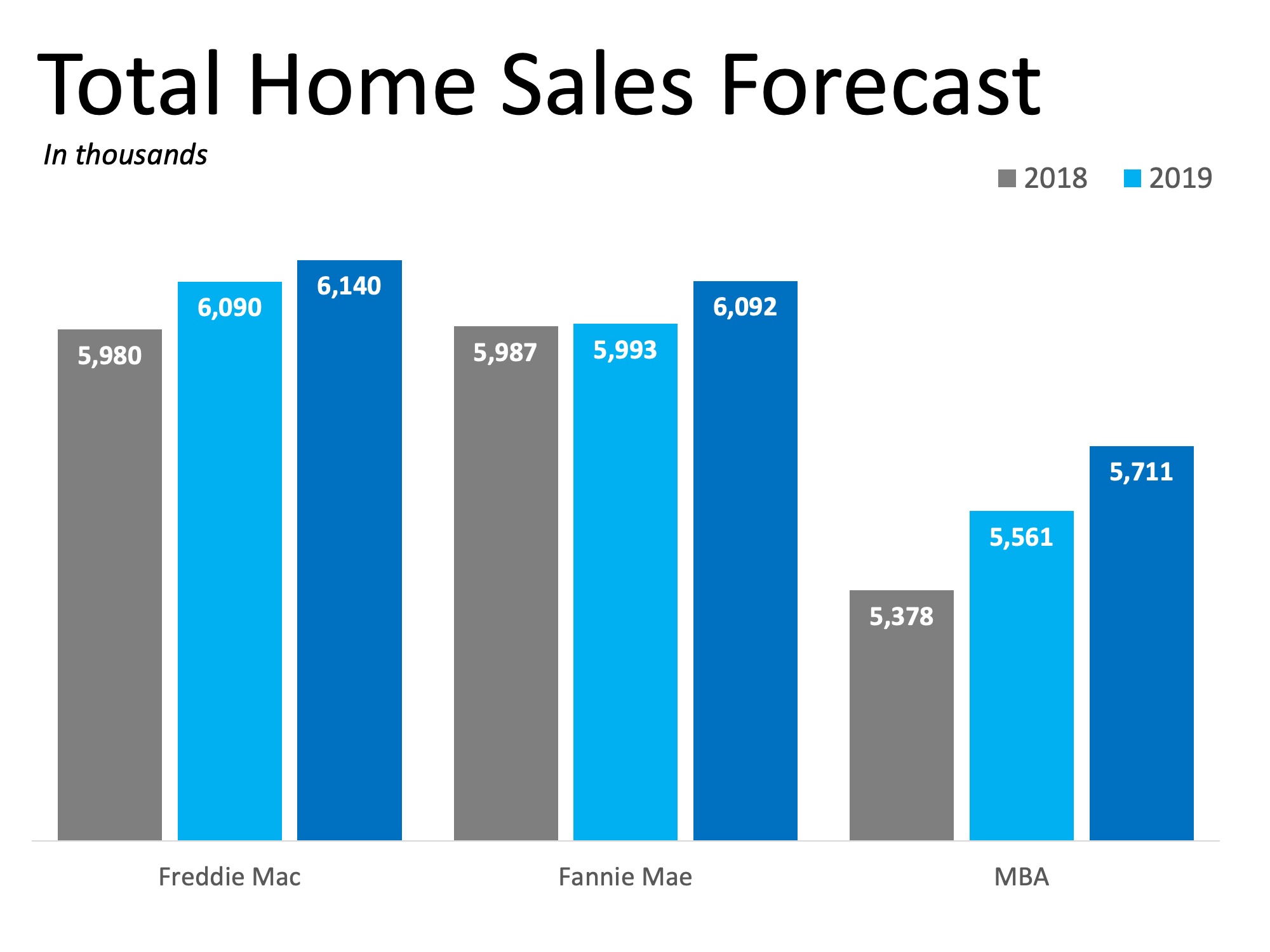

At least 3 of the renowned organizations that report on real estate market trends predict that homeowners are going to wait until 2020 to list their homes, leading to a nice increase in sales (as shown in the graph below).

Don’t wait for a competitive market; be ahead of the curve and sell your house at the best possible price!

Bottom Line

There are plenty of buyers entering the market! Whether you’re a first-time homebuyer or a current homeowner looking to move-up to your next home, let’s get together to discuss your real estate needs!

Monday, February 18, 2019

Millionaire To Millennials: Don’t Get Stuck Renting A Home… Buy One!

Millionaire To Millennials: Don’t Get Stuck Renting A Home… Buy One!

In a CNBC article, self-made millionaire David Bach explained that: “The biggest mistake millennials are making is not buying their first home.” He goes on to say that, “If you want to build real financial security, real wealth for your lifetime, then you need to buy a home.”

Bach went on to explain:

“Homeowners are worth 40 times more than renters. Now, that first home doesn’t need to be a dream home, it can be a very small home. You might literally have to buy a small studio apartment, but that’s how you get started.”

Then he explains the secret to buying that home!

“Don’t do a 30-year mortgage. You want to take that 30-year mortgage and instead pay it off early, do a 15-year mortgage. What happens if you do a 15-year mortgage? Well, one, you pay the mortgage off 15-years sooner, that means you’ll be able to retire in your fifties. Number two, you’ll save a fortune (on potentially hundreds of thousands of dollars in interest payments).”

What will it cost to pay your mortgage in fifteen years? He explains further:

“For fifteen years, you got to brownbag your lunch. Think about that! Brownbag your lunch literally for fifteen years. You can retire ten years sooner than your friends. You’ll have real wealth, because you bought a home – you’re not a renter. And you’ll be financially secure for life.”

Bottom Line

Whenever a well-respected millionaire gives investment advice, people usually clamor to hear it. This millionaire gave simple advice – if you don’t yet live in your own home, go buy one.

Friday, February 15, 2019

Where Did Americans Move in 2018?

Where Did Americans Move in 2018? [INFOGRAPHIC]

![Where Did Americans Move in 2018? [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2019/02/13071843/2019-02-15-MovingAcrossAmerica-ENG-MEM-1046x1354.jpg)

Some Highlights:

- Every year United Van Lines conducts their National Movers Study by tracking their customer’s movement state-to-state over the course of the year.

- Vermont claimed the top spot of states with the highest percentage of inbound residents following a campaign that covered relocation costs for skilled workers who moved to the state.

- The most common response for why someone relocated to another state was for a new job or company transfer.

Thursday, February 14, 2019

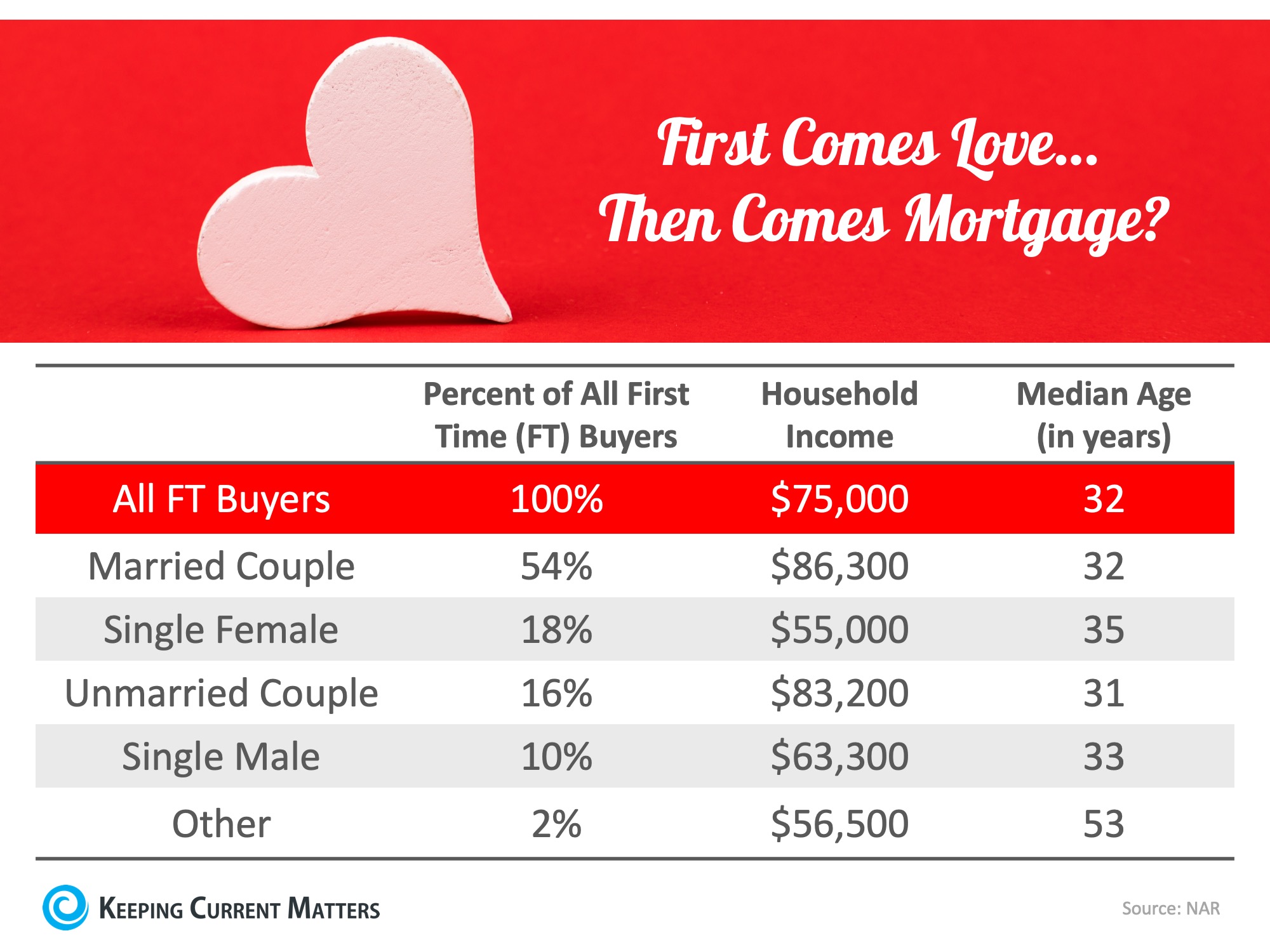

First Comes Love… Then Comes Mortgage? Couples Lead the Way

First Comes Love… Then Comes Mortgage? Couples Lead the Way

According to the National Association of REALTORS most recent Profile of Home Buyers & Sellers, married couples once again dominated the first-time homebuyer statistics in 2018 at 54% of all buyers. It is no surprise that buying a home is more attainable with two incomes to save for down payments and contribute to monthly housing costs.

However, many couples are also deciding to buy a home before spending what would be a down payment on a wedding. Last year, unmarried couples accounted for 16% of all first-time buyers.

If you’re single, don’t fret! Single women made up 18% of first-time buyers in 2018, while single men accounted for 10% of buyers. One recent article pointed to a sense of responsibility and commitment that drives many single women to want to own their home, rather than rent.

Here is the breakdown of all first-time homebuyers in 2018 by percentage of all buyers, income, and age:

Bottom Line

You may not be that much different than those who have already purchased their first homes. Let’s get together to determine if your dream home is already within your grasp!

Wednesday, February 13, 2019

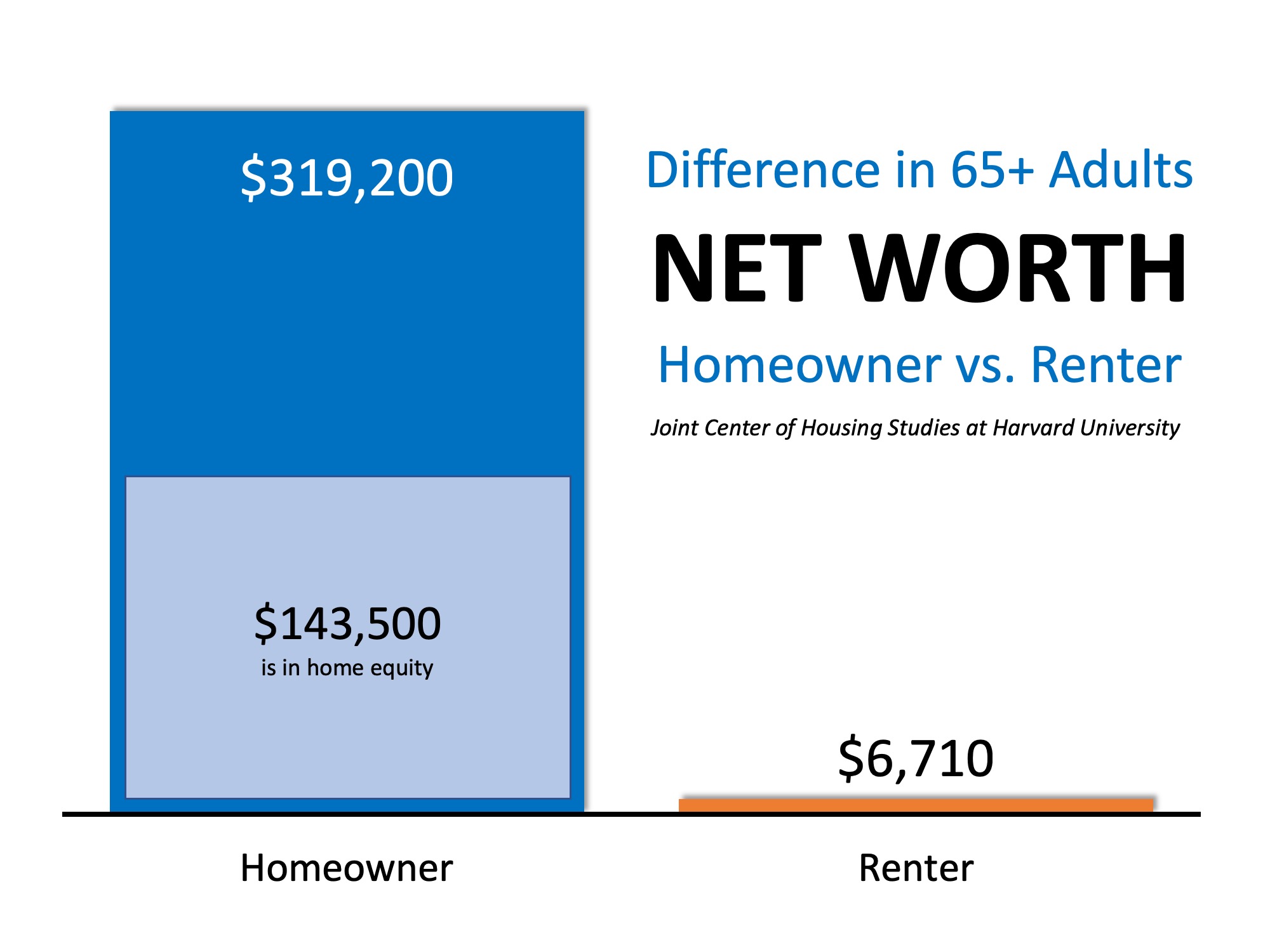

Why Homeownership Matters Now More Than Ever

Why Homeownership Matters Now More Than Ever

Study after study shows that no matter what generation Americans belong to, the vast majority believe that homeownership is an important part of their American Dream. The benefits of homeownership can be broken into two main categories: financial and non-financial (often referred to as emotional or social reasons.)

For Americans approaching retirement age, one of the greatest benefits to homeownership is the added net worth they have been able to achieve simply by paying their mortgage!

The Joint Center for Housing Studies at Harvard University focused on homeowners and renters over the age of 65. Their study revealed that the difference in net worth between homeowners and renters at this age group was actually 47.5 times greater, with nearly half their net worth coming from home equity!

Homeowners over the age of 65 are much more financially prepared for retirement and often own their homes outright if they were fortunate enough to purchase their homes before the age of 36.

Their 30 years of mortgage payments have paid off as they gained equity through their monthly payments and as home values appreciated.

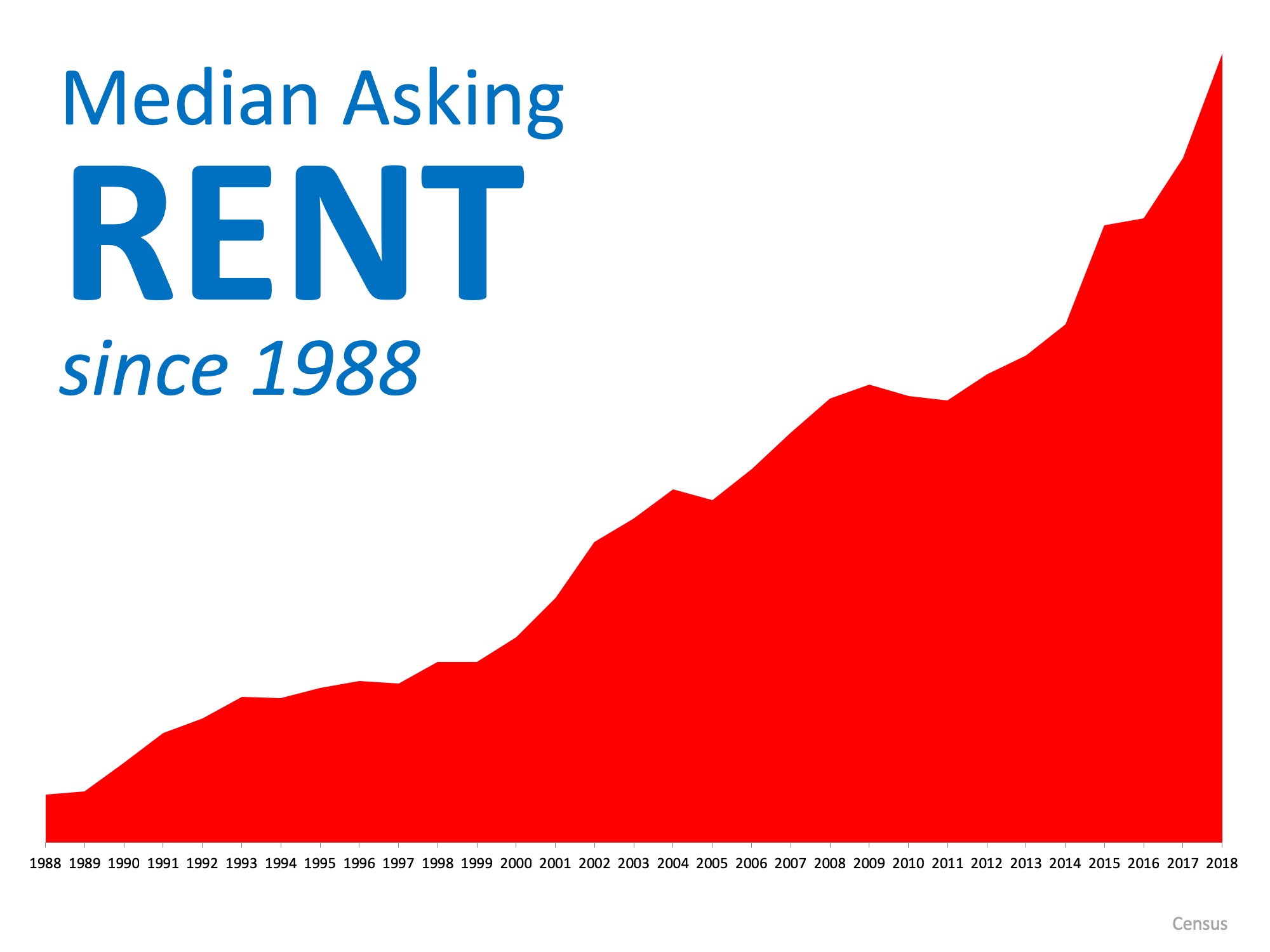

It is no surprise that lifelong renters have had a hard time accruing net worth as the latest Census report shows that the Median Asking Rent has been climbing consistently over the last 30 years.

Bottom Line

Bottom Line

Your monthly mortgage payment is a form of ‘forced savings’ building your net worth with every payment!

Tuesday, February 12, 2019

How To List Your Home for the Best Price

How To List Your Home for the Best Price

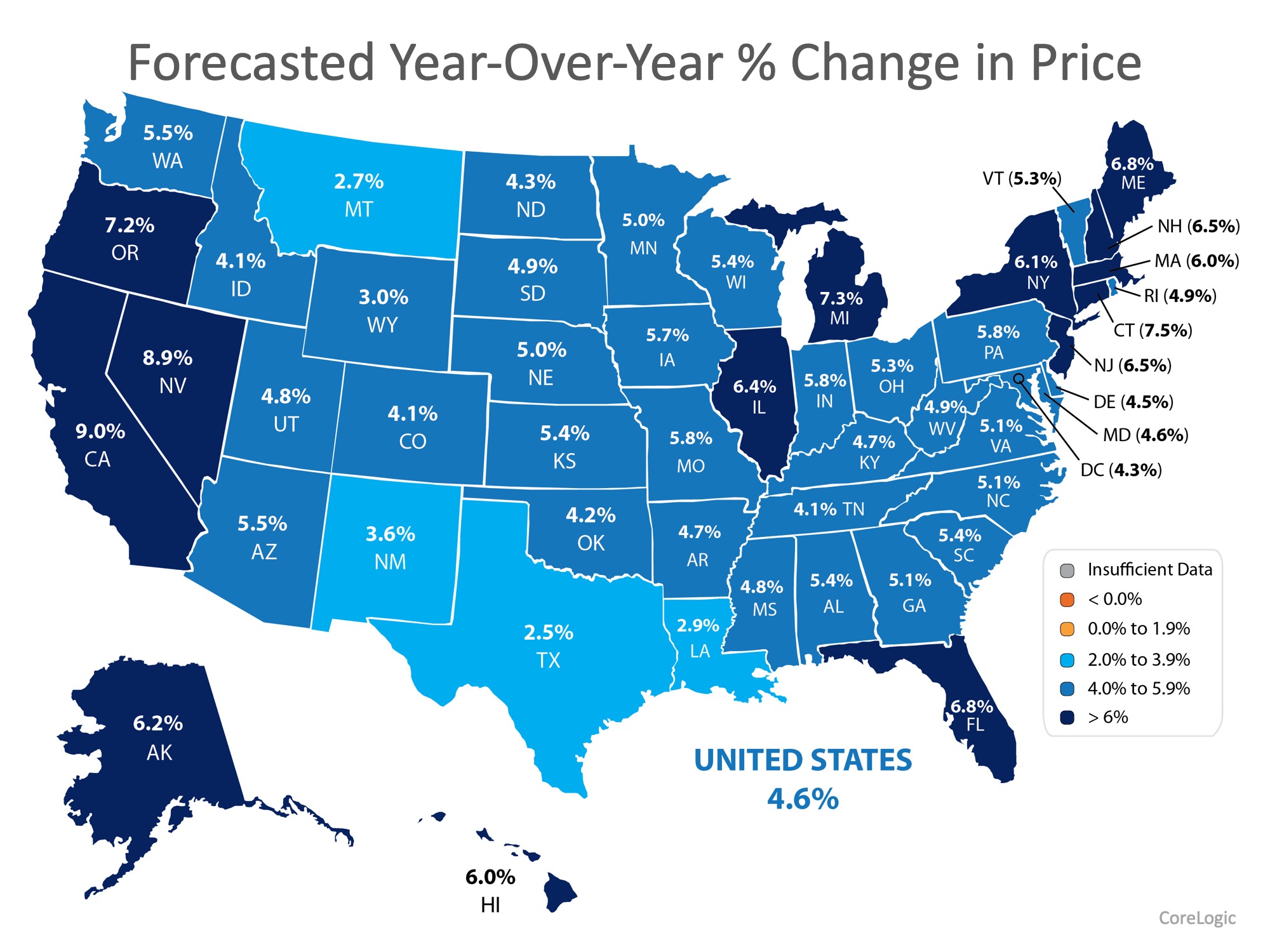

If your plan for 2019 includes selling your home, you will want to pay attention to where experts believe home values are headed. According to the latest Home Price Index from CoreLogic, home prices increased by 4.7% over the course of 2018.

The map below shows the results of the latest index by state.

Real estate is local. Each state appreciates at different levels. The majority of the country saw at least a 2.0% gain in home values, while some residents in North Dakota and Louisiana may have felt prices slow slightly.

This effect will be short lived. In the same report, CoreLogic forecasts that every state in the Union will experience at least 2.0% appreciation, with the majority of the country gaining at least 4.0%! The prediction for the country comes in at 4.6%. For a median-priced home, that translates to over $14,000 in additional equity next year! (The map below shows the forecast by state.)

So, how does this help you list your home for the best price?

Armed with the knowledge of how much experts believe your house will appreciate this year, you will be able to set an appropriate price for your listing from the start. If homes like yours are appreciating at 4.0%, you won’t want to list your home for more than that amount!

One of the biggest mistakes homeowners make is pricing their homes too high and reducing the price later when they do not get any offers. This can lead buyers to believe that there may be something wrong with the home, when in fact the price was just too high for the market.

Bottom Line

Pricing your home right from the start is one of the most challenging parts of selling your home. Once you decide to list your house, let’s get together to discuss where home values are headed in your area!

Monday, February 11, 2019

Thinking of Selling Your House? This is a Perfect Time!

Thinking of Selling Your House? This is a Perfect Time!

It is common knowledge that a great number of homes sell during the spring buying season. For that reason, many homeowners hold off putting their homes on the market until then. The question is whether or not that is a good strategy this year.

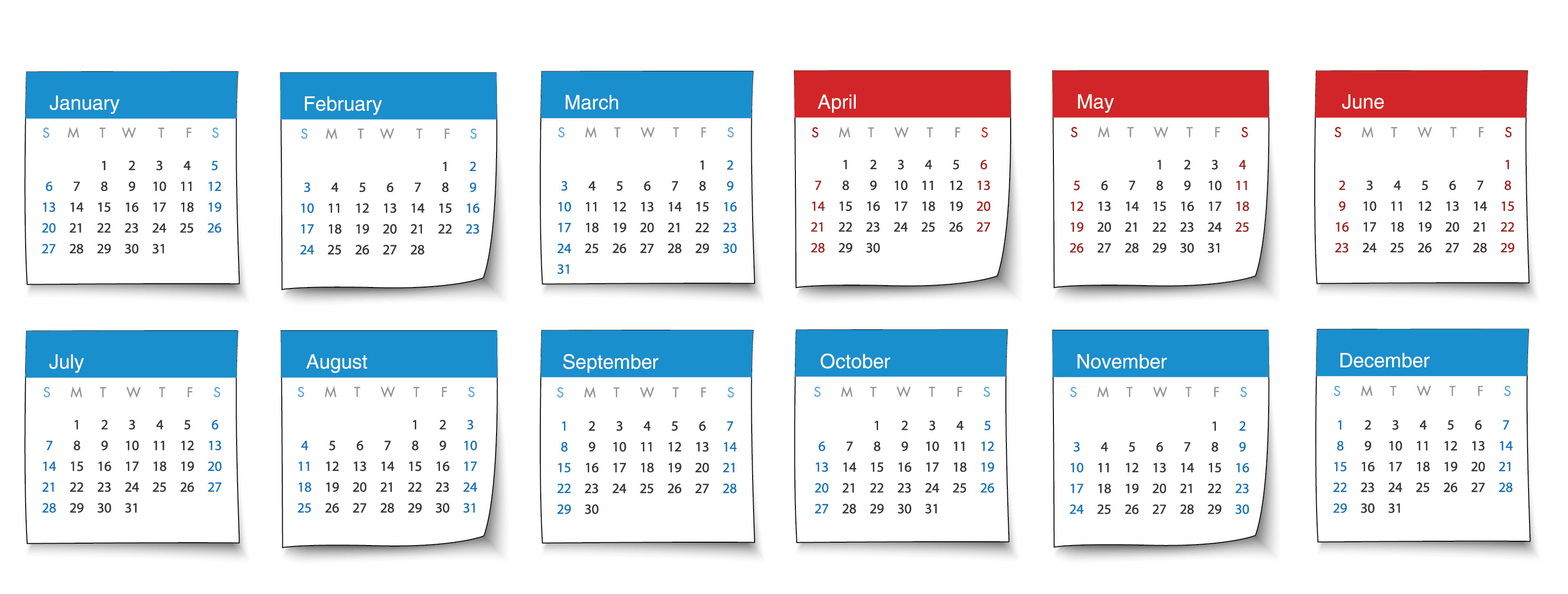

The other listings that come out in the spring will represent increased competition to any seller. Do a greater number of homes actually come to the market during this season in comparison to the rest of the year? The National Association of Realtors(NAR) recently revealed the months during which most people listed their homes for sale in 2018. This graphic shows the results:

The three months in the second quarter of the year (represented in red) are consistently the most popular months for sellers to list their homes on the market. Last year, the number of homes available for sale in January was 1,520,000.

That number spiked to 1,870,000 by May!

What does this mean to you?

With the national job situation improving and mortgage interest rates projected to rise later in the year, buyers are not waiting until the spring; they are out looking for homes right now.

Bottom Line

If you are looking to sell this year, waiting until the spring to list your home means you will have the greatest competition amongst buyers. Beat the rush of housing inventory that will enter the market and list your home today!

Subscribe to:

Comments (Atom)