U.S. homebuilders' confidence bounced back strongly this month, a sign that construction and industry hiring may pick up in coming months.

The National Association of Home Builders/Wells Fargo builder sentiment index released Tuesday climbed to 58. That was up from 54 in November and matched an eight-year high reached in August. Readings above 50 indicate that more builders view sales conditions as good than poor.

In addition, builders' view of current sales conditions jumped this month to the highest level in eight years. And their outlook for sales heading into next year's spring home-selling season also improved.

The index has stayed above 50 now for seven straight months after being below that level since May 2006. This month's reading is 11 points higher than a year ago. It reflects a U.S. housing market fueled by steady job growth and still-low mortgage rates.

The latest index suggests that builders remain optimistic that the housing recovery will endure even though mortgage rates have risen in recent months.

"The recent spike in mortgage interest rates has not deterred consumers as rates are still near historically low levels," said David Crowe, the NAHB's chief economist. "We continue to look for a gradual improvement in the housing recovery in the year ahead."

Mortgage rates peaked at 4.6 percent in August and have stabilized since September, when the Federal Reserve surprised markets by taking no action on starting to reduce its bond purchases. Its bond purchases are intended to keep long-term interest rates low, including mortgage rates.

The Fed ends a two-day policy meeting Wednesday, after which it will release a statement and projections for the economy.

Mortgage buyer Freddie Mac said last week that the average rate on the 30-year loan declined to 4.42 percent from 4.46 percent a week earlier. In November last year, the average had dipped as low as 3.31 percent, the lowest on records dating to 1971.

Sales of new homes slowed over the summer after mortgage rates rose sharply and a tight supply of homes for sale boosted prices. The combination made home-buying less affordable.

But Americans ramped up purchases of new homes in October 25.4 percent to a seasonally adjusted annual rate of 444,000, according to the Commerce Department.

All told, sales of newly built homes have risen 21.6 percent for the 12 months ending in October. Still, the pace remains well below the 700,000 consistent with a healthy market.

And there are signs that builders are preparing for less growth. Approved permits to build single-family houses began to flat line in the spring, while spending on home construction spending fell 0.5 percent in October from September.

Still, the latest NAHB survey, which included responses from 346 builders, shows builders' outlook is rising again after dimming during the 16-day partial shutdown in October.

A measure of current sales conditions for single-family homes climbed six points to 64, the highest level since December 2005. Builders' outlook for single-family home sales over the next six months rose two points from November to 62, while a gauge of traffic by prospective buyers increased three points from last month to 44.

Though new homes represent only a fraction of the housing market, they have an outsize impact on the economy. Each home built creates an average of three jobs for a year and generates about $90,000 in tax revenue, according to data from the homebuilders association.

A top Realtor in the Savannah area. Jeri Patrick has a team with an established history of success of selling homes in and around the Savannah Area. Jeri specializes in the home buying and selling process and is available to answer any of your real estate questions, provide information and handle any obstacles that may arise. Jeri Patrick began her Real Estate careers in 2002. Jeri’s strong ambition to be a success created a driving force in today’s real estate market.

Sunday, December 22, 2013

Real Estate Dictionary

Real Estate Dictionary

CMA —

Comparative Market Analysis: A report generated by your agent that helps to determine an approximate value of your property.Home Staging —

Also, Home Stager – Home stagers help you to prepare your property to achieve the best sale price and also reduce the amount time your home is on the market. The goal of home staging is to make a home appealing to the highest number of potential buyers, enabling the owner to sell the property more swiftly and for more money.Open House —

A scheduled time where a house or apartment for sale or rent is open for visits from the public. The Open House is usually hosted by either a real estate agent or in some cases the actual homeowner.Advertising Packages —

All agents have different techniques, strategies and skills in advertising. So ask them what they can do for you!Appointment Scheduling —

Does your agent schedule appointments themselves or is it handled by their support staff?MLS —

Means the Multiple Listing Service. A group of privately owned databases that provide member real estate agents and prospective buyers with properties that are available for sale in the United States and Canada.Caravan/Agent Tour —

A caravan involves inviting real estate agents into a home, or more often a series of homes, listed for sale in hopes of achieving higher visibility and marketing.Customized Feature Sheets —

A customized feature sheet provides an accurate depiction of the seller’s property for prospective home buyers to keep and gives them a resource to look back at when they leave the home.Installation Of A “For Sale” Sign —

A service real estate professionals provide to advertise your home for sale, lease or rent that’s usually installed on your front lawn.Lockbox Services —

The main purpose of a lockbox is that it facilitates the sale of the home. Without it, selling or buying a home would be much more difficult. It allows a safe and easy way for Agents to get the keys to open your house and show your property to their clients.Virtual Tours —

Virtual tour photography, 360° virtual tours, or a panoramic virtual tour is a highly efficient way of gaining more market exposure, faster than other marketing strategies.Newspaper Advertising —

This section of the local newspaper is one of the popular choices for real estate agents to effectively advertise their new listings.Internet Advertising —

Real estate agents can advertise your property on many different websites. For example, they can advertise your home on their personal as well as their broker’s website.4 Reasons why your home hasn't sold

The decision to sell a home is likely going to be one of the

most important decisions you will ever make. It’s ranked right up there as

being one of the most stressful times you will ever go through. To add to the

stress of deciding to sell your home, imagine your home has now been on the market

for months and it is not selling! Talk about stress! You may find yourself

asking “Why hasn’t my home sold?!”

There are a number of reasons why a home doesn’t get sold.

1.

The price is wrong

“Price

your home to sell”. Too many homes that do not sell once they are listed for

sale are due to the wrong price being set; it’s that simple. There is a prudent, tried and tested way to

set a list price and it’s not about the mortgage balance that has to be

covered, what a neighbor may say a home is worth, what a homeowner “feels”

their home is worth, what Zillow says a home’s value is or what will enable a

Real Estate Agent to secure the listing over other Real Estate Agents. Was this

what happened to you and you wonder why your home hasn’t sold?!

A thorough analysis of the local Real Estate market must be

combed through where closed sales, pending sales, active sales, price points

and absorption rates are reviewed, so a home’s list price is set to sell.

2. Your home was not presented well

Presentation is always key in getting a home sold

particularly with the vast majority of Buyers, over 90%, who start their home

search online over the Internet. If a

home that is listed for sale is not presented well, how will a Buyer ever

notice it? A home has to be sparkling

clean, brightly lit, neat and tidy both inside and out. Photos of the home must

highlight these features that matter, and there must be plenty of photos that a

Buyer can lay their eyes upon; a handful of photos is never enough. I’m always amazed when I come across homes

listed for sale that are showing just a few photos or photos that are dark and

dreary, rooms a mess and just simply a poor presentation. Was this what your home looked like while

languishing on the market and you wonder why it didn’t sell?! More times than not, a Seller doesn’t even

know how awful their home has been presented.

A Real Estate Agent should always show the home Seller how they

represent the Seller’s home across the Internet.

3. You were not

cooperative in the home selling process

In any successful transaction, cooperation that avoids

friction will lead to a favorable outcome. Cooperate and you’ll have harmony.

This doesn’t mean that home Sellers need to throw up their hands and surrender

everything, but understand that it’s a little give and take from both the Buyer

and Seller. It can never be about

digging one’s heels in the sand. What requires cooperation when selling a home?

Listed below are a few of the common things requiring cooperation:

•Ease of home showings – being too restrictive of when

prospective Buyers can visit a Seller’s home can lead to the Buyer skipping the

home altogether while deciding to buy a neighbor’s home down the street. The home should be allowed to be shown during

normal daylight hours and early evening hours.

And of course, there can be an occasional exception when something pops

up and a showing may need to be rescheduled.

•Adhering to timelines of the Real Estate contract. When a contract timeline requires that a

signature and/or initial be returned by a certain date, this must be followed

otherwise, the Buyer can cancel their original intent to purchase.

•Promptly providing return of documents. There may be times

when a home Seller will be inconvenienced in order to get documents returned on

time, but that’s okay as it’s all for the greater good of getting a home sold.

•Promptly responding to efforts of communication. A preferred method of communication can be

set at the onset of the home selling process and it’s imperative that you get

back to your Agent in a timely manner, which is as soon as possible that same

day. A reply shouldn’t be expected to have to wait for hours and hours on end;

the sooner the better.

4. You hired the

wrong Real Estate Agent

Where do I begin?

When the wrong Real Estate Agent is hired, it can pretty much be

expected that #1, #2 and #3 will be what follows. When a skilled Real Estate Agent has been selected

she/he will know how to price a home to sell, will know how a home must be

presented to sell, and will speak with the home Sellers on what to expect

during the home selling process so communication will be that of cooperation.

This step can be downright terrifying, as it’s likely known

by now, that far too many Agents will call themselves experts, experts at

whatever it is a home Seller is in need of; whether it’s a Short Sale, a

Relocation, representing young adults, older adults, multi family, single

family home and on and on, everybody seems to want to call themselves an expert

even when they’re not; talk about lacking integrity. We cannot be a jack of all trades.

So what do you look for when selecting the Right Real Estate

Agent? Some of the desired key traits are listed below:

•Professional who demonstrates high integrity and

trustworthiness.

•Skilled at marketing homes and oneself which is evident in

a Google search; Google their name and you should see them blasted across the

internet as the Real Estate professional you’d hire. If they can’t market

themselves they won’t be able to reach Buyers to sell homes.

•Proven track record of selling homes, not just a handful of

homes each year.

•Proven track record of getting top dollar for homes sold.

•Knowledgeable of the local Real Estate market

•Passion for their job as a Realtor

•Excellence in communication and negotiation skills

•Favorable customer reviews. Quite often you can be assured

of the above traits when you read a customer review. Many of my customers

routinely spell it out in their favorable reviews they present of me.

Was the Real Estate Agent you had hired lacking in the above

traits and now you likely know why your home didn’t sell.

Within the very first few weeks of a home being listed for

sale is when a home needs to attract the attention of a Buyer, as this is when

the new home listing is nice and warm, just fresh on the market like that

freshly baked bread out of the oven and those Buyers who have been watching for

new homes to become available for sale will be all over a hot new listing and

also, any new Buyers just coming to market will also notice a new home just

listed and when the 4 reasons above were avoided from day one, a sold sign will

be showing in the front yard very quickly.

Know that the selling of a home doesn’t have to end this

way, you can get off on the right foot by calling a trusted Real Estate

professional.

Thursday, December 19, 2013

New Mortgages to Get Pricier Next Year

Increase in Fannie, Freddie Fees to Hit Borrowers Without Perfect Credit or Big Down Payments

The mortgage giants said late Monday that, at the direction of their regulator, they will charge higher fees on loans to borrowers who don't make large down payments or don't have high credit scores—a group that represents a large share of home buyers. Such fees are typically passed along to borrowers, resulting in higher mortgage rates.Fannie and Freddie, which currently back about two-thirds of new mortgages, don't directly make mortgages but instead buy them from lenders. The changes are aimed at leveling the playing field between the government-owned companies and private providers of capital, who are mostly out of the mortgage market now. Fannie and Freddie were bailed out by the government during the financial crisis but are now highly profitable.

The Federal Housing Finance Agency last week signaled the fee increases but didn't provide details. The agency's move came one day before the Senate voted to confirm Rep. Mel Watt (D., N.C.) as its director. It isn't clear whether Mr. Watt, who hasn't yet been sworn in, weighed in on the changes. An FHFA spokeswoman declined to comment on any discussions with Mr. Watt, who also declined to comment.

Mr. Watt will face heavy pressure by consumer groups and the real-estate industry to reverse course, industry officials said Tuesday. "There will be significant opposition very quickly once people understand what is actually being implemented," said Martin Eakes, chief executive of the Center for Responsible Lending in Durham, N.C., a consumer-advocacy nonprofit.

The changes take effect in March but will be phased in by lenders earlier. The fee increases come as the Federal Reserve contemplates an end to its bond-buying program, which has kept mortgages rates low, and as new mortgage-lending regulations take effect next month.

"The timing of it is impeccably bad," said Lewis Ranieri, co-inventor of the mortgage-backed security. "The question becomes: how much can housing take?"

In updates posted to their websites on Monday, Fannie and Freddie showed that fees will rise sharply for many borrowers who don't have down payments of at least 20% and who have credit scores of 680 to 760. (Under a system devised by Fair Isaac Corp. FICO -1.75%Fair Isaac Corp.

A borrower seeking a 30-year fixed-rate mortgage with a credit score of 735 and making a 10% down payment, for instance, would pay fees totaling 2% of the loan amount, up from 0.75% now. The 2% upfront fee could raise the mortgage rate by around 0.4 percentage points.

Borrowers with larger down payments could also be affected. Fees for a loan with a 690 credit score and a 25% down payment would rise to 2.25% from 1.5%.

Executives at Fannie and Freddie said last month that the fees they have been charging are enough to cover expected losses, but that those fees might need to rise in order to allow private investors, which target a higher rate of return, to compete. An FHFA official Tuesday said that even with the latest changes, Fannie's and Freddie's fees would be considered low relative to private firms'.

Mr. Ranieri, who runs a mortgage-investment firm, predicted that the move would backfire and hit the economy. Because the private sector isn't strong enough to lend more, "all this will do is tighten credit. You're just making housing less affordable," he said.

Industry executives also said the magnitude of the increases was a surprise. "It's like Beyoncé's album: It all of a sudden hit the market," said David Stevens, chief executive of the Mortgage Bankers Association.

In recent months, some large banks have been offering "jumbo" mortgages, which are too large for government backing, at rates below the conforming mortgages that are eligible for purchase by Fannie and Freddie for borrowers with the best credit. The higher fees could make conforming mortgages even more expensive than jumbos.

The changes follow other announcements in recent weeks that could raise loan costs for some borrowers. The Federal Housing Administration, a government agency that guarantees loans with down payments as small as 3.5%, said earlier this month that it would drop the maximum loan limit in around 650 counties. In San Bernardino, Calif., for example, the loan limit will fall to $335,350 next month from the current level of $500,000.

Separately, the FHFA said Monday it would study reducing the loan amounts that Fannie and Freddie guarantee by around 4%, bringing the national limit to $400,000 from its current level of $417,000. Those changes won't take effect before October 2014, the agency said.

Wednesday, December 18, 2013

Monday, December 16, 2013

Office Party Etiquette

What to find out in advance: Which top bananas will be there, so you can think up something smart to say.

Declutter: This Week Project: Organize Your Attic

The Jeri Patrick Team,

A Superior Level of Service

When you offer a superior level of service, word

spreads fast!

Keller Williams Realty offers the services you need to sell your home in

today's market.

Savannah Real Estate Pros Keller Williams Realty

Jeri Patrick Team – Homes for Sale Savannah, Pooler, Rincon, Richmond Hill, Guyton, West Chatham and the surrounding Low Country

Friday, December 13, 2013

Thursday, December 12, 2013

Horizon home Builders of Savannah

Southern Coastal Homes, Builder, Glennville, Ricky, Bradley. Parrish Carpentry, LLC ... Horizon Home Builders, Builder, Savannah,

home builders in Savannah, GA?

Are you looking for new home builders in Savannah, GA? Who are the top Builders in Savannah? Regal Builders? Horizon Home Builders? Synergy Designer Homes? Beacon Builders? DR Horton? Landmark? Mungo?

can help you find the perfect home builder. Listed below are new home builder ...

Equal Housing Opportunity Home Builders Association of Greater Savannah Realtor ® 2-10 Home Buyers Warranty. Trusted Homebuilder in America. Landmark 24 Homes & Realty, Inc logo ... Equal Housing Opportunity Home Builders Association of Greater Savannah Realtor ® 2-10 Home Buyers Warranty ®. Regal Builders of the Coastal Empire, Synergy Designer Homes, Horizon Home Builders,Mungo Homes is a new home builder, proudly offering new communities in Savannah and surrounding areas.building new homes in Savannah, GA that are perfect for all types of buyers

can help you find the perfect home builder. Listed below are new home builder ...

Equal Housing Opportunity Home Builders Association of Greater Savannah Realtor ® 2-10 Home Buyers Warranty. Trusted Homebuilder in America. Landmark 24 Homes & Realty, Inc logo ... Equal Housing Opportunity Home Builders Association of Greater Savannah Realtor ® 2-10 Home Buyers Warranty ®. Regal Builders of the Coastal Empire, Synergy Designer Homes, Horizon Home Builders,Mungo Homes is a new home builder, proudly offering new communities in Savannah and surrounding areas.building new homes in Savannah, GA that are perfect for all types of buyers

Tuesday, December 10, 2013

Monday, December 9, 2013

Sunday, December 8, 2013

Search Properties

Savannah Real Estate Pros Keller Williams Realty

Jeri Patrick Team – Homes for Sale Savannah, Pooler, Rincon, Richmond Hill, Guyton, West Chatham and the surrounding Low Country

In today’s complex and difficult real estate market you need a professionals who will do whatever it takes to market and sell your home. Jeri Patrick has a team with an established history of success of selling homes in and around the Savannah Area. Jeri specializes in the home buying and selling process and is available to answer any of your real estate questions, provide information and handle any obstacles that may arise.

Find Homes For Sale in Savannah. Search Savannah, Georgia real estate, recently sold properties, foreclosures, new homes, school. Homes.com Savannah, GA Real Estate: Search houses for sale and MLS listings in Savannah, Georgia. Local information. savannahrealestatepros.com has Savannah, GA homes for sale listings. ... Search Savannah houses, condos, townhomes and single-family homes by price and location

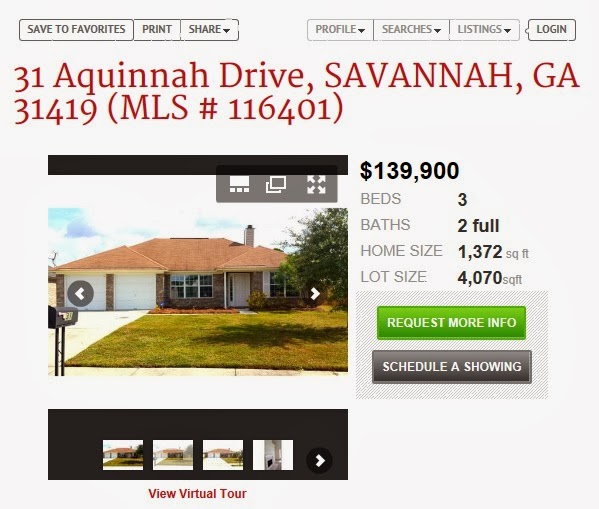

31 AQUINNAH DR, Hampton Place

Jeri

Patrick Team

Jeri

Patrick Team – Homes for Sale Savannah, Pooler, Rincon, Richmond Hill, Guyton,

West Chatham and the surrounding Low Country

Charming home desirable Pooler location. Close to everything Pooler has to offer; the Up-n-coming shops, restaurants and I-16/I-95. Unique Opportunity, well maintained, clean, freshly painted and new carpet. Fenced yard. This home will not be on the market long!

16 CASTLE HILL RD, The Villages at Berwick

Jeri

Patrick Team

Jeri

Patrick Team – Homes for Sale Savannah, Pooler, Rincon, Richmond Hill, Guyton,

West Chatham and the surrounding Low Country

64 Quail Forest Drive

Jeri

Patrick Team

Jeri

Patrick Team – Homes for Sale Savannah, Pooler, Rincon, Richmond Hill, Guyton,

West Chatham and the surrounding Low Country

970 Rushing ST

Jeri

Patrick Team

Jeri

Patrick Team – Homes for Sale Savannah, Pooler, Rincon, Richmond Hill, Guyton,

West Chatham and the surrounding Low Country

Desirable Richmond Hill location, in quiet Rushing Station community. Freshly

painted. Convenient to schools and shopping. Close to I95 and HWY 17. 100%

Financing, no money down program available. Ideal for first time home buyer or

great investment opportunity. Nothing needed. Ready for Move in!

14 CASTLE HILL RD, The Villages at Berwick

Jeri

Patrick Team

Jeri

Patrick Team – Homes for Sale Savannah, Pooler, Rincon, Richmond Hill, Guyton,

West Chatham and the surrounding Low Country

Looking for something special? Simplicity and sophistication are found

throughout this newly designed plan. Regal's newest 2-story home boasts a formal

dining room, great room, downstairs flex space and upstairs loft all rooms are

wide, open, roomy and spacious. Look no more, this home is it!

3 Costly Cases of Hot Market Wishful Thinking

Posted Under: Home Buying | December 3, 2013 10:07 AM | 47,760 views | 36 comments

“Oh, how I wish. . .” started no wise real estate decision ever. There’s a reason they call it real estate, folks. That’s because we’re dealing with the most tangible type of property around - land - and the buildings that, formally speaking, represent improvements to that land.

“Oh, how I wish. . .” started no wise real estate decision ever. There’s a reason they call it real estate, folks. That’s because we’re dealing with the most tangible type of property around - land - and the buildings that, formally speaking, represent improvements to that land.

Attempting to apply fantasy-realm wishes to real-life, real land situations is never a setup for success. But when the market is hot and you have a goal or a timeline, engaging in wishful thinking is not just foolhardy - it can be costly.

As evidence, here are three common, costly cases of wishful thinking that tend to arise in areas where the market is hot, offers are plentiful and prices are rising. Consider these red flags and take heed in the event you find yourself engaging in any of them:

1. Wishing the house you’re seeing was in a different neighborhood. You’ve seen 2 dozens houses, and put in offers on a dozen. No dice. And your agent keeps pushing you to look in a lower price range, assuring you that you can find what you want. And then they show it to you: safe neighborhood, good school district, good commute to work, just the house you wanted, really - but not in the tony hills or hot downtown district you’ve been trying to get into.

Wishing that you could “pick the place up and set it back down” in your desired neighborhood will not make it so, no matter how many times you say it. The reality is that when you have been outbid a double-digit number of times, something about your approach is not working. You either have to downgrade your specs in terms of the property you seek, maybe looking for something smaller, a condo instead of a single-family home or something in less-pristine condition or you need to shift your location criteria - and that can mean a neighborhood change.

Part of the reason this wish is dangerous is that the white-hot markets in many towns are hyper-localized in the Most Desirable Neighborhood in Town. That’s where the competition among buyers and bidding wars are the most intense. If you’re not prepared to house hunt for homes quite a bit lower than your top dollar to set yourself up for success, or if there simply are no homes in that neighborhood listed below your top dollar, you might need to face the reality check that you simply can’t afford to buy there now.

Stop wishing the home you can afford were in a different neighborhood, because if it were, chances are good you wouldn’t be able to afford it, either! Understand that you’ll be able to level-up your neighborhoods as time goes on and you buy your next home - and the one after that - and don’t let your inflexibility paralyze your house hunt so long that prices all over town rise even more.

2. Hoping that perfect house gets no other offers, even though every other house you’ve bid on has had 54. There’s a fine line between wishing something were true and denying the reality of what actually is true. Facing reality, even when it’s painful or means you can’t have what you want, allows you to make your own action plan for getting the best possible results with the resources you have - or a plan for getting more resources, whichever route you choose to go.

As a buyer in a seller’s market, actually as a buyer in any type of market, it’s ultimately up to you and only you how much you offer on a home. Your mortgage broker can try to get you qualified as high as your income will allow, your agent can get you the comps and give you strategic advice on the average list price-to-sale price ratio, but you are the be-all and end-all decision-maker on offer price, and that’s as it should be.

But if you wield your weighty decision-making power to make lowball or at-asking offers in situations where you are virtually guaranteed to run into high levels of competition, that’s a poor use of your powers. Not only do you set yourself up for failure, you do so at the near-certain likelihood of adding to the demotivating, depressing, discouraging momentum of the times when you get overbid despite giving it your legitimate best efforts. That frustration often leads to analysis and calling a house hunting time-out. And that, in turn, often leads to buying at a time when prices are even higher, and getting ultimately even less home for your money.

3. Wishing prices weren’t going up so fast. Here’s the deal: when prices were flat or falling, buyers were (understandably) stressed at the prospect of buying a depreciating asset. Now that they’re ascending, it’s not at all uncommon to hear buyers bemoan that, too. The fact is, the moment escrow closes and your Facebook status changes from house hunter to home owner the fact that prices are rising, and fast, will shift in your mind’s eye from curse to blessing, quick-like.

Rising prices and a recovering market might be what emboldened you to buy, empowered you to sell a formerly underwater home, and certainly have been inextricably intertwined with the increase in jobs. If prices weren’t rising, many of these other things might not be materializing, either, and that wouldn’t be so great.

Wishing prices weren’t going up so fast contributes to a costly form of denial - denial of the reality that they are. This can cause buyers to persist in making lowball offers and wasting their precious time on homes they can’t compete for within in their budget range, all while their smart targets are appreciating rapidly - and that’s how people get priced out of the market, right under their noses.

Don’t let your home buyer dreams fall prey to this costly wish-based pitfall. Work with your agent to stay in the loop about how prices are trending throughout your house hunt, and use that knowledge to power your decision-making about what price range to house hunt in and what price to offer for target properties.

ALL: What are your real estate wishes, and how do you ground yourself in reality?

PS: You should follow Trulia and Tara on Facebook!

“Oh, how I wish. . .” started no wise real estate decision ever. There’s a reason they call it real estate, folks. That’s because we’re dealing with the most tangible type of property around - land - and the buildings that, formally speaking, represent improvements to that land.

“Oh, how I wish. . .” started no wise real estate decision ever. There’s a reason they call it real estate, folks. That’s because we’re dealing with the most tangible type of property around - land - and the buildings that, formally speaking, represent improvements to that land. Attempting to apply fantasy-realm wishes to real-life, real land situations is never a setup for success. But when the market is hot and you have a goal or a timeline, engaging in wishful thinking is not just foolhardy - it can be costly.

As evidence, here are three common, costly cases of wishful thinking that tend to arise in areas where the market is hot, offers are plentiful and prices are rising. Consider these red flags and take heed in the event you find yourself engaging in any of them:

1. Wishing the house you’re seeing was in a different neighborhood. You’ve seen 2 dozens houses, and put in offers on a dozen. No dice. And your agent keeps pushing you to look in a lower price range, assuring you that you can find what you want. And then they show it to you: safe neighborhood, good school district, good commute to work, just the house you wanted, really - but not in the tony hills or hot downtown district you’ve been trying to get into.

Wishing that you could “pick the place up and set it back down” in your desired neighborhood will not make it so, no matter how many times you say it. The reality is that when you have been outbid a double-digit number of times, something about your approach is not working. You either have to downgrade your specs in terms of the property you seek, maybe looking for something smaller, a condo instead of a single-family home or something in less-pristine condition or you need to shift your location criteria - and that can mean a neighborhood change.

Part of the reason this wish is dangerous is that the white-hot markets in many towns are hyper-localized in the Most Desirable Neighborhood in Town. That’s where the competition among buyers and bidding wars are the most intense. If you’re not prepared to house hunt for homes quite a bit lower than your top dollar to set yourself up for success, or if there simply are no homes in that neighborhood listed below your top dollar, you might need to face the reality check that you simply can’t afford to buy there now.

Stop wishing the home you can afford were in a different neighborhood, because if it were, chances are good you wouldn’t be able to afford it, either! Understand that you’ll be able to level-up your neighborhoods as time goes on and you buy your next home - and the one after that - and don’t let your inflexibility paralyze your house hunt so long that prices all over town rise even more.

2. Hoping that perfect house gets no other offers, even though every other house you’ve bid on has had 54. There’s a fine line between wishing something were true and denying the reality of what actually is true. Facing reality, even when it’s painful or means you can’t have what you want, allows you to make your own action plan for getting the best possible results with the resources you have - or a plan for getting more resources, whichever route you choose to go.

As a buyer in a seller’s market, actually as a buyer in any type of market, it’s ultimately up to you and only you how much you offer on a home. Your mortgage broker can try to get you qualified as high as your income will allow, your agent can get you the comps and give you strategic advice on the average list price-to-sale price ratio, but you are the be-all and end-all decision-maker on offer price, and that’s as it should be.

But if you wield your weighty decision-making power to make lowball or at-asking offers in situations where you are virtually guaranteed to run into high levels of competition, that’s a poor use of your powers. Not only do you set yourself up for failure, you do so at the near-certain likelihood of adding to the demotivating, depressing, discouraging momentum of the times when you get overbid despite giving it your legitimate best efforts. That frustration often leads to analysis and calling a house hunting time-out. And that, in turn, often leads to buying at a time when prices are even higher, and getting ultimately even less home for your money.

3. Wishing prices weren’t going up so fast. Here’s the deal: when prices were flat or falling, buyers were (understandably) stressed at the prospect of buying a depreciating asset. Now that they’re ascending, it’s not at all uncommon to hear buyers bemoan that, too. The fact is, the moment escrow closes and your Facebook status changes from house hunter to home owner the fact that prices are rising, and fast, will shift in your mind’s eye from curse to blessing, quick-like.

Rising prices and a recovering market might be what emboldened you to buy, empowered you to sell a formerly underwater home, and certainly have been inextricably intertwined with the increase in jobs. If prices weren’t rising, many of these other things might not be materializing, either, and that wouldn’t be so great.

Wishing prices weren’t going up so fast contributes to a costly form of denial - denial of the reality that they are. This can cause buyers to persist in making lowball offers and wasting their precious time on homes they can’t compete for within in their budget range, all while their smart targets are appreciating rapidly - and that’s how people get priced out of the market, right under their noses.

Don’t let your home buyer dreams fall prey to this costly wish-based pitfall. Work with your agent to stay in the loop about how prices are trending throughout your house hunt, and use that knowledge to power your decision-making about what price range to house hunt in and what price to offer for target properties.

ALL: What are your real estate wishes, and how do you ground yourself in reality?

PS: You should follow Trulia and Tara on Facebook!

3 Costly Cases of Wishful Thinking in a Buyer's Market

Posted Under: Home Selling | December 3, 2013 10:09 AM | 2,492 views | 3 comments

You’d think that wishes would be welcome in real estate. I mean, they call it your “dream home,” right? And even the fairy tales and fables are full of real estate imagery. There are towers, huts, castles and houses made from straw, wood, brick - I seem to recall one that was even made from a shoe!

You’d think that wishes would be welcome in real estate. I mean, they call it your “dream home,” right? And even the fairy tales and fables are full of real estate imagery. There are towers, huts, castles and houses made from straw, wood, brick - I seem to recall one that was even made from a shoe!

Reality check: the real-world real estate market does not operate on wishes and dreams. While it's fine to put a vision in place for the outcome you'd like to have from your home's sale, there is a line some sellers cross that ends up costing them significant amounts of time, money and opportunities to get their homes sold and move forward with their lives.

Sellers, how can you make sure that you are setting up an actionable plan, complete with targets and timelines, vs. playing in a fantasyland of costly denial and wishful thinking? Here are a few red flag scenarios. If you find yourself mentally lingering in any of these fantasies, you might want to course correct your thinking.

1. Wishing a wealthy buyer would just fall in love with your home enough to pay an above-market list price, all-cash, no questions asked. While I understand the thinking behind this one, that thinking is flawed - deeply flawed. The rationale goes: a wealthy buyer will be able to pay cash, so they won’t get an appraisal - or won’t be bound by it if they do get one. If they just love the place enough, they’ll be willing to do what rich people do, and indulge their heart’s desire by paying what I want for this place (even though my agent says that’s way too much).

Let me count the flaws in this thought process.

First, there’s a reason the average wealthy person stays wealthy, and that reason is because they are good stewards of the money they have. The classic book The Millionaire Next Door went so far as to provide proof points for the proposition that the average, everyday wealthy person is actually quite frugal, preferring low-budget wine to costly vintages and Timexes to Rolexes.

They make no exception for their real estate dealings. Well-off buyers still want to get every bit of value out of their dollars, so are maybe even less likely to pay a list price unsupported by comparables than a buyer with less cash on hand. And many wealthy folk will mortgage their homes, to keep their cash liquid and take advantage of the mortgage interest deduction, whether or not they have enough cash to buy your home outright - so the fantasy of no appraisal showers of cash is simply that: fantasy.

The very best way, in any market climate, to get top dollar for your home is to price it in a way that in an online search, it stands out from the competition as a strong value.

2. Wishing your home would just sell already. After all, the neighbor’s house did! If your home is lagging on the market while others fly on and off, wishing will not solve your problem. Strategic action will.

I once read an old Dale Carnegie book in which he gave the advice to put a “stop-loss order on your worries.” It’s always stuck in my mind as a simple, but vivid, reminder that the best practice in life is to refuse to waste your valuable time and energy worrying and wishing about things that have already happened or are inevitable. Instead, he said, accept what’s already done and get on the stick doing damage control or, even better, making lemonade from your lemons.

Some 70 years after Carnegie wrote it, this advice is still highly appropriate for sellers in buyer’s markets who find themselves with a case of this type of wishful thinking. Truth is, a large segment of buyers who are active at this time of year have tax, financial and lifestyle goals they are trying to meet by closing escrow before year’s end. Spending your - and their - precious moments of time on wishing is a setup for frustration and for missing out on the opportunity to sell your home to one of these urgent buyers.

Instead of worry-ridden wishing, get on the calendar for a course-correcting, action-planning strategy session with your agent. Go in understanding that their goal is to get your home sold, too. Throughout the meeting, keep an open mind and ear to their advice about the staging, pricing and marketing changes they recommend making, and don’t end the session until you have an agreed-upon calendar for completing them.

3. Wishing you had listed your home earlier in the year. October data from the National Association of Realtors® revealed that pending home sales nationwide have dropped for the fifth month in a row, due to interest rate and home price increases. This is not cause for alarm, as sales are still up year-over-year. In fact, these slight declines in buyer activity might simply reflect an expectable rollback in homes going into contract after the fever-pitched buyer activity pace we saw at the beginning of 2013.

Here’s how one analyst explained it to Bloomberg News: “'When mortgage rates went up, people got spooked and rushed into the market to seal deals,' Patrick Newport, an economist at IHS Global Insight in Lexington, Massachusetts, said. . .. 'The numbers that we’re seeing for pending home sales are payback for the stronger numbers earlier this year.'"

Maybe you originally thought about listing your home last year or this Spring, but you’ve just now gotten all your ducks in a row to get the place on the market. Or maybe it took you a while to realize that your once-underwater home is now in the black, empowering you to list it for sale - and now you regret not having listed it sooner. In any event, wishing you were doing something you didn’t do at a time you didn’t do it has never been a fruitful strategy, no matter what the context. In fact, I believe that things happen when they are supposed to happen. Bemoaning that they didn’t happen on some other timeline can cause you to overlook advantages that might operate in your favor, if only you opened your eyes to them.

There are buyers out there for well-prepared, clean, well-priced and smartly marketed homes in every market, no matter the time of year or the climate of the weather. Pay attention to the average number of days recently sold homes in your area took to sell, and don’t get upset or panicked about your home’s sale until you and your agent feel that your home is lagging, compared with the average.

Keep in mind that buyers who continue house hunting during the holiday season and in inclement weather tend to be some of the most serious, qualified and motivated buyers of the entire year. As well, seller competition can be lower this time of year, when many sellers are holding off to list or re-list their homes after January 1st. And stay mindful of the power you wield to control your home’s listing and sale. If you are convinced that selling at the beginning of the year is advantageous to selling at the end, you can take heart in the fact that the beginning of a whole new year is just around the corner!

SELLERS: Have you found yourself engaging in wishful thinking? What specific wishes come to your mind?

AGENTS: How do you help your seller clients get and stay grounded in reality?

PS: You should follow Trulia and Tara on Facebook!

You’d think that wishes would be welcome in real estate. I mean, they call it your “dream home,” right? And even the fairy tales and fables are full of real estate imagery. There are towers, huts, castles and houses made from straw, wood, brick - I seem to recall one that was even made from a shoe!

You’d think that wishes would be welcome in real estate. I mean, they call it your “dream home,” right? And even the fairy tales and fables are full of real estate imagery. There are towers, huts, castles and houses made from straw, wood, brick - I seem to recall one that was even made from a shoe!Reality check: the real-world real estate market does not operate on wishes and dreams. While it's fine to put a vision in place for the outcome you'd like to have from your home's sale, there is a line some sellers cross that ends up costing them significant amounts of time, money and opportunities to get their homes sold and move forward with their lives.

Sellers, how can you make sure that you are setting up an actionable plan, complete with targets and timelines, vs. playing in a fantasyland of costly denial and wishful thinking? Here are a few red flag scenarios. If you find yourself mentally lingering in any of these fantasies, you might want to course correct your thinking.

1. Wishing a wealthy buyer would just fall in love with your home enough to pay an above-market list price, all-cash, no questions asked. While I understand the thinking behind this one, that thinking is flawed - deeply flawed. The rationale goes: a wealthy buyer will be able to pay cash, so they won’t get an appraisal - or won’t be bound by it if they do get one. If they just love the place enough, they’ll be willing to do what rich people do, and indulge their heart’s desire by paying what I want for this place (even though my agent says that’s way too much).

Let me count the flaws in this thought process.

First, there’s a reason the average wealthy person stays wealthy, and that reason is because they are good stewards of the money they have. The classic book The Millionaire Next Door went so far as to provide proof points for the proposition that the average, everyday wealthy person is actually quite frugal, preferring low-budget wine to costly vintages and Timexes to Rolexes.

They make no exception for their real estate dealings. Well-off buyers still want to get every bit of value out of their dollars, so are maybe even less likely to pay a list price unsupported by comparables than a buyer with less cash on hand. And many wealthy folk will mortgage their homes, to keep their cash liquid and take advantage of the mortgage interest deduction, whether or not they have enough cash to buy your home outright - so the fantasy of no appraisal showers of cash is simply that: fantasy.

The very best way, in any market climate, to get top dollar for your home is to price it in a way that in an online search, it stands out from the competition as a strong value.

2. Wishing your home would just sell already. After all, the neighbor’s house did! If your home is lagging on the market while others fly on and off, wishing will not solve your problem. Strategic action will.

I once read an old Dale Carnegie book in which he gave the advice to put a “stop-loss order on your worries.” It’s always stuck in my mind as a simple, but vivid, reminder that the best practice in life is to refuse to waste your valuable time and energy worrying and wishing about things that have already happened or are inevitable. Instead, he said, accept what’s already done and get on the stick doing damage control or, even better, making lemonade from your lemons.

Some 70 years after Carnegie wrote it, this advice is still highly appropriate for sellers in buyer’s markets who find themselves with a case of this type of wishful thinking. Truth is, a large segment of buyers who are active at this time of year have tax, financial and lifestyle goals they are trying to meet by closing escrow before year’s end. Spending your - and their - precious moments of time on wishing is a setup for frustration and for missing out on the opportunity to sell your home to one of these urgent buyers.

Instead of worry-ridden wishing, get on the calendar for a course-correcting, action-planning strategy session with your agent. Go in understanding that their goal is to get your home sold, too. Throughout the meeting, keep an open mind and ear to their advice about the staging, pricing and marketing changes they recommend making, and don’t end the session until you have an agreed-upon calendar for completing them.

3. Wishing you had listed your home earlier in the year. October data from the National Association of Realtors® revealed that pending home sales nationwide have dropped for the fifth month in a row, due to interest rate and home price increases. This is not cause for alarm, as sales are still up year-over-year. In fact, these slight declines in buyer activity might simply reflect an expectable rollback in homes going into contract after the fever-pitched buyer activity pace we saw at the beginning of 2013.

Here’s how one analyst explained it to Bloomberg News: “'When mortgage rates went up, people got spooked and rushed into the market to seal deals,' Patrick Newport, an economist at IHS Global Insight in Lexington, Massachusetts, said. . .. 'The numbers that we’re seeing for pending home sales are payback for the stronger numbers earlier this year.'"

Maybe you originally thought about listing your home last year or this Spring, but you’ve just now gotten all your ducks in a row to get the place on the market. Or maybe it took you a while to realize that your once-underwater home is now in the black, empowering you to list it for sale - and now you regret not having listed it sooner. In any event, wishing you were doing something you didn’t do at a time you didn’t do it has never been a fruitful strategy, no matter what the context. In fact, I believe that things happen when they are supposed to happen. Bemoaning that they didn’t happen on some other timeline can cause you to overlook advantages that might operate in your favor, if only you opened your eyes to them.

There are buyers out there for well-prepared, clean, well-priced and smartly marketed homes in every market, no matter the time of year or the climate of the weather. Pay attention to the average number of days recently sold homes in your area took to sell, and don’t get upset or panicked about your home’s sale until you and your agent feel that your home is lagging, compared with the average.

Keep in mind that buyers who continue house hunting during the holiday season and in inclement weather tend to be some of the most serious, qualified and motivated buyers of the entire year. As well, seller competition can be lower this time of year, when many sellers are holding off to list or re-list their homes after January 1st. And stay mindful of the power you wield to control your home’s listing and sale. If you are convinced that selling at the beginning of the year is advantageous to selling at the end, you can take heart in the fact that the beginning of a whole new year is just around the corner!

SELLERS: Have you found yourself engaging in wishful thinking? What specific wishes come to your mind?

AGENTS: How do you help your seller clients get and stay grounded in reality?

PS: You should follow Trulia and Tara on Facebook!

311 E HALL ST

Jeri

Patrick Team

Jeri

Patrick Team – Homes for Sale Savannah, Pooler, Rincon, Richmond Hill, Guyton,

West Chatham and the surrounding Low Country

Approved Short Sale! Park at your front door! First floor private condo that

includes a parking space directly in front. Large windows with tons of natural

light. Granite in the kitchen, hardwood floors and 9ft ceilings throughout.

Condo fees include water and trash. Property does need some TLC.

217 SEBRING DR

Jeri

Patrick Team

Jeri

Patrick Team – Homes for Sale Savannah, Pooler, Rincon, Richmond Hill, Guyton,

West Chatham and the surrounding Low Country

The perfect breather from a busy lifestyle,you'll immediately sense the feeling

of space and the balance of comfortable,casual living both inside and out.New

HVAC and roof. All brick split plan with extra-large bedrooms centering around

family living bringing the heart of the home-the Kitchen-alive.

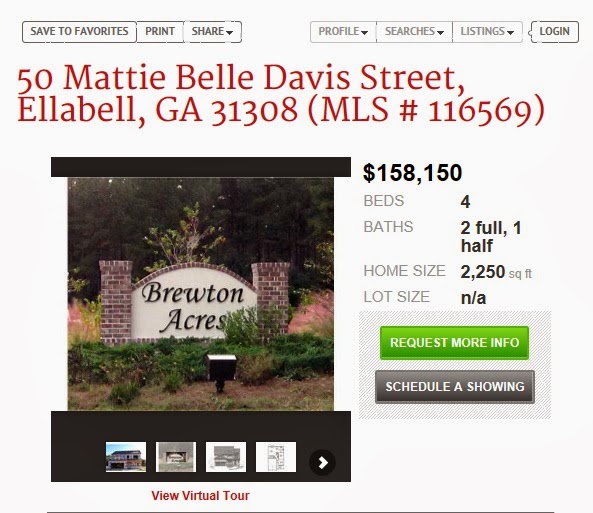

50 MATTIE BELLE DAVIS ST

Jeri

Patrick Team – Homes for Sale Savannah, Pooler, Rincon, Richmond Hill, Guyton,

West Chatham and the surrounding Low Country

Situated on a 1/2 acre home site in the newly loved community of Brewton Acres. Regal Builder's Sonata, an alluring home with great room, loft, formal living and dining allowing for tons of actual living space; desirable final touches which polish this home nicely. Now is the time for your sections!

Subscribe to:

Posts (Atom)